LAKELAND, FL (August 11, 2021) – GiveWell Community Foundation (GWCF) is pleased to announce a new Balanced Pool investment option for fundholders. As the name implies, this new investment pool offers a balanced strategy of equity and fixed income investing.

Assets of the Community Foundation have historically been invested in three primary pools: Cash, Long-term, and Conservative. With the new Balanced Pool, we now have the following options to offer our fundholders:

- Our Cash Pool invests in cash and is designed for liquidity to meet immediate philanthropic needs rather than providing an investment return.

- Introduced in 2018, our Conservative Pool, is comprised of roughly 30% in equities and 70% in fixed income to provide fundholders a conservative-to-diversified portfolio.

- Our Long-Term Pool is comprised of roughly 70% in equities and 30% in fixed income to provide fundholders a moderate-to-aggressive portfolio.

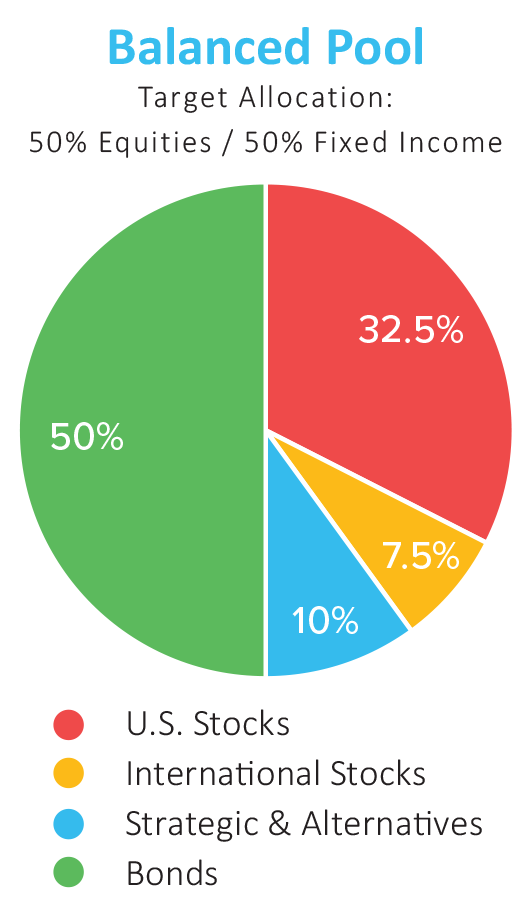

- Our new Balanced Pool falls between the Long-Term and Conservative pools, offering fundholders 50% in equities and 50% in fixed income and striking a balance between being positioned for moderate growth while not being exposed to substantial value-eroding risk.

All four investment pools are now available to fund advisors. If you would like to learn more about your fund investment options, please call us at 863-683-3131 or visit givecf.org/giving/investing.

Funds at GWCF are part of a large institutional investment pool managed by CAPTRUST, which allows broad diversification and cost-effective management. GWCF’s Investment Committee provides oversight, guidance, and direction regarding the investment of the Community Foundation’s assets.